China’s transition from a manufacturer of generic drugs to a powerhouse of biotech innovation is redrawing the pharmaceutical landscape. Europe in particular needs to sit up and take notice.

These days, the hottest innovations in biotechnology are just as likely to come from Shanghai and Beijing as Boston or San Francisco. Once regarded as merely a producer of cheap generic medicines, China has made huge strides in life sciences in recent years, creating novel medicines that have grabbed the attention of the world’s biggest pharmaceutical companies.

Around one third of the money spent on drug licensing deals in 2024 was ploughed into products originating in Chinese laboratories. The hectic pace of deal-making has continued this year, with global drugmakers committing up to $48.5 billion in partnerships with Chinese biotech firms in the first half of 2025, exceeding the $44.8 billion spent in all of 2024. As the new go-to source of promising experimental treatments, the country seems to be on track to disrupt the biotech market in the same way as it is done in electric vehicles, where it has raced ahead of rivals.

For outsiders looking on nervously, the prospect of well-designed Chinese molecules accounting for an ever-larger share of the world’s medicine chest is both a threat and an opportunity.

Nowhere is this clearer than in Europe, where the life sciences sector is struggling to stay competitive. Europe was overtaken by the US in 2000 as the top region in the world for pharmaceutical innovation—and since then it has fallen behind further, with China producing more novel medicines than Europe for the first time in 2023.

To investigate the potential and risks of working with Chinese life science companies, Brunswick recently conducted a survey to assess perceptions towards mutual investment between Europe and China. The results provide valuable insights on opinions ranging across scientific innovation, sales growth, intellectual property rights and geopolitical risks. So, what are the key messages?

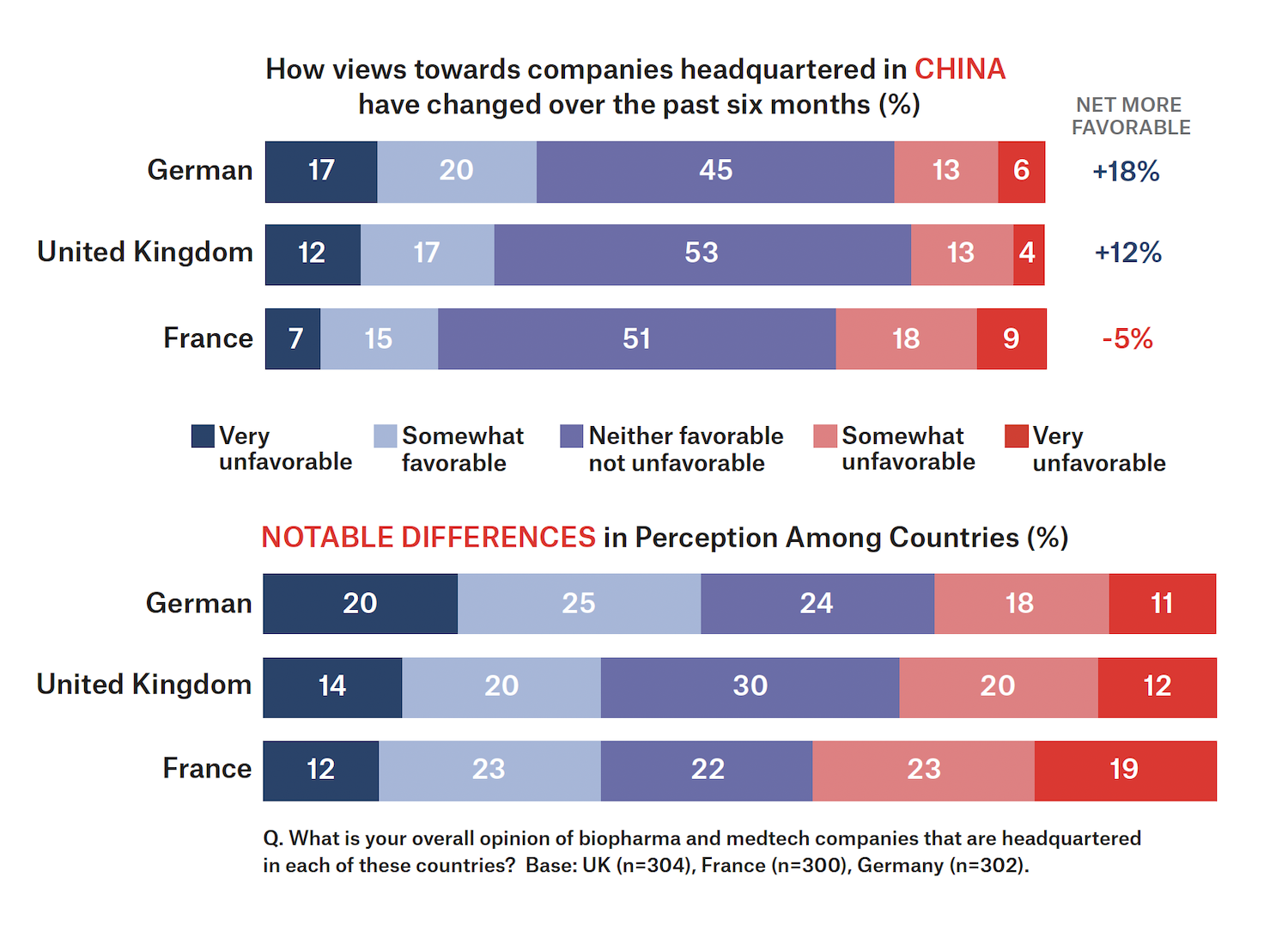

First, views of Chinese companies in Europe are becoming more favorable. The positive perception is especially strong in Germany, followed by the UK, while France is less enthusiastic.

Second, perceptions of China’s innovative abilities remain largely stuck in the past. The highest-ranked attribute associated with Chinese bioscience among Europeans is affordability—a view harking back to China’s role as a supplier of cheap generics. China’s capacity to deliver novel, effective modern treatments is placed well behind peers in the US, Switzerland and Germany. China also lags on perceptions of safety and transparency.

Third, informed public opinion is alert to the risks and rewards linked to doing business with China. The educated public sees the promise of long-term growth being offset by concerns over political opposition from Western governments, the diversion of resources from domestic life sciences investment and the danger of losing intellectual property.

Understanding all these pull and push factors will be critical for management teams as more China-origin products reach the market in the next few years, requiring businesses to develop a narrative that highlights the opportunities and addresses the concerns, in order to build support among key stakeholders.

One thing is clear: The importance of China in bioscience is only going to increase. The country has a unique combination of scientific talent, state support, a huge pool of patients, and an ability to run clinical trials faster and cheaper than Europe or the US. That makes China a great place to develop medicines for complex diseases like cancer, diabetes, obesity and immune system disorders. As a result, Morgan Stanley believes the annual revenue from drugs originating in China could reach $34 billion by 2030 and $220 billion in 2040, by which time they are forecast to make up 35% of all US Food and Drug Administration approvals, up from just 5% today.

China’s pipeline of promising experimental treatments is a treasure trove that global pharmaceutical companies cannot afford to ignore—especially as the industry hunts for replacements to products with combined sales of some $200 billion that face a “cliff” of patent expiries this decade.

But just as individual companies need to develop a China strategy that can cope with both opportunity and risk, so too do governments.

China’s quantum leap in innovation is not a result of a string of isolated breakthroughs. It is a function of a coordinated national strategy. Successes in sectors like biotech and electronic vehicles reflect a system that integrates policy incentives, massive infrastructure investments, regulatory and intellectual property reforms, as well as public-private collaboration.

There are important lessons here for Europe at a time when the continent is falling behind rivals and urgently needs to create a more agile ecosystem for innovation. European initiatives like the new Life Sciences Strategy are a step in the right direction, but turning plans into action is a tortuous process. The European Union has implemented just 11% of the proposals made last year by former Italian premier Mario Draghi to boost the bloc’s economic competitiveness.

Partnerships between Europe’s life sciences sector and China hold potential benefits for both sides—provided they are built on reciprocity and trust. For Europe, engaging with China could accelerate R&D breakthroughs, deliver faster and more affordable treatments to patients, and strengthen Europe’s position in global innovation networks. China, meanwhile, stands to gain by diversifying its innovation partnerships, building trust in global markets and accelerating adoption of its technologies.

The volatile nature of both US-China and Europe-China geopolitical relations inevitably brings risks and uncertainties. Collaborations must be pursued with clear-eyed recognition of the risks, but there is an opening for Europe as a third economic bloc with the potential to span the 21st century’s two dominant powers. Leaning into that opportunity means embracing innovation, wherever it is found.

“Don’t make the same mistakes as the car industry—by staying disunited and resisting innovation,” said Pascal Lamy, Senior Advisor at Brunswick and former Director General of the World Trade Organization. “We have to be somewhere between the US and China. That’s our space to define.”