Around the world, climate-related disruptions are no longer theoretical risks, but here-and-now realities for business.

Above, Tourists visiting Sun Moon Lake in Taiwan during a drought in 2021 found only a dry lake bed.

We live in a time of interconnected crises, and it’s the growing intensity of those issues, looked at through the lens of investors, that has propelled the rise of ESG.

Fundamentally, ESG has emerged as a way for investors to assess the resilience of business in the face of these intensifying challenges.

“Resilience” comes from the Latin resiliens—to “jump back.” In business, it means the ability of a company to respond and adapt quickly to disruptions that threaten people, operations, reputation and profit.

Of course, investors need a way to understand the resilience of business amid societal disruption. They need to know the degree of exposure companies face to environmental and social risks. Investors must be able to assess how well companies can resume operations after a disruption. Investors need broadly to understand a company’s vulnerability to major external trends.

This has been driven by climate. Climate impacts have often been seen as futuristic. But they are no longer remote risks; they are realities businesses face today. Three in 10 businesses worldwide have already experienced operational impacts from climate change, according to a report by Deloitte.

In this section we offer snapshots of recent climate-related disruptions that have challenged businesses’s resilience.

The Tech Industry

Faces Climate-Related Disruption

Taiwan’s semiconductor industry, which dominates the global microchip marketplace, has faced repeated water shortages due to drought, threatening tech supply chains. In Malaysia, a typhoon caused unprecedented flooding, impacting a critical node in the global semiconductor supply chain—chips are sent to Malaysia for packaging before being shipped to the US and Europe. The knock-on effects of these disruptions have been far reaching, causing some US automobile manufacturers to suspend production.

The growth of cloud-based AI services is expected to dramatically increase tech-related water use. Server farms rely on vast amounts of water for cooling, and water use is projected to grow at a compound annual growth rate of 5.6% until the end of the decade. Some companies are already exploring alternative approaches—such as Microsoft’s Project Natick, which is submerging server farm modules in the North Sea.

Water Shortages Dent the

Resilience of the Consumer Goods Industry

Better water resource management is one of three key ESG metrics that drives financial performance for consumer goods companies, according to a study by Boston Consulting Group. Enhanced conservation of water use alone correlated to higher earnings of 3.1 percentage points.

In 2022, a drought in Canada disrupted global supplies of mustard seed—a staple ingredient for food manufacturers. France, for instance, depends on Canadian imports of mustard seed. Analysis by NielsenIQ showed an 88% drop in the availability of mustard products for French consumers.

ROADS: Extreme heat places greater strains on roads, engines and tires. Its effects can be measured everywhere from increased fuel consumption to cracked concrete and melted asphalt. One estimate from the US Senate concluded that the additional road maintenance caused by extreme heat could cost a total of $26 billion by 2040.

AVIATION: Heat waves are more likely to ground flights than cold weather or storms. Aircraft performance is degraded by low air density, making it harder for planes to take off. Planes get 1% less lift with every 5.4°F (3°C). As one report concluded, to deal with extreme heat, “The airline has a few choices: Fly with less fuel, luggage or people.”

TRAINS: Steel absorbs heat easily and steel rails can reach temperatures of 140°F (60°C) in a heatwave. This now happens with increasing frequency; the steel expands and buckles, causing significant travel disruption. This isn’t only a problem for commuters—many businesses rely on rail freight in their supply chains.

Texas Freeze

Estimated to Cost $300 Billion

An ice storm in Texas in 2021 caused the worst involuntary blackout in US history, which led to shutdowns in technology and manufacturing plants, as well as severing supply chain links with the Pacific Northwest. Even a year later, businesses were reported to be struggling to recover from economic losses caused by damage to machinery and buildings.

The Federal Reserve Bank of Dallas estimated the storm cost the state economy as much as $130 billion—and that statewide measures to prevent a similar failure (such as winterizing oil and gas wells to prevent them from freezing) would total as much as $200 million annually.

Low Rainfall

Disrupts Global Trade

The volume of ships passing through the Panama Canal has been dramatically reduced by a severe drought, resulting in disruption to global shipping. The canal relies on water from rainfall, and has been down to a capacity of 16 ships a day. In normal times, 40% of US container traffic passes through the canal.

In the UK, the media reported delays on goods such as iPhones and exercise bikes as a result of the drought, as well as increases in the costs of some foods. As Bloomberg reported, the world faces a shipping traffic jam that could cost up to $270 billion.

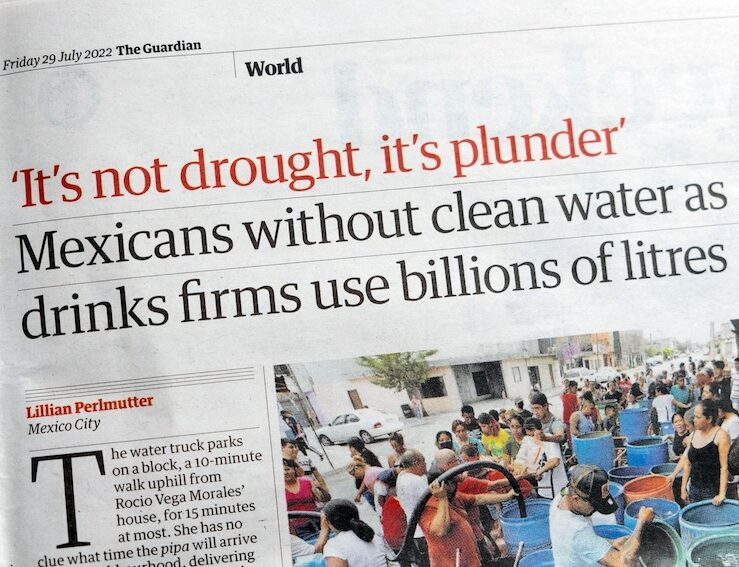

Mexico Drought Leads to Reputation Hit for Drinks

In 2022, community organizations in Mexico called for a global boycott of beverage companies that continued to extract groundwater even as the country struggled with a historic drought and parts of Mexico City were being supplied by water trucks. The global media headlines thrust beverage companies into the glare of international inquiry and protests popularized the slogan, “No es sequía, es saqueo” (“It’s not drought, it’s plunder”). That particular drought ended, but water availability has remained a critical issue into 2024.

Many of the companies named by the global press have extensive water sustainability strategies, with explicit goals for managing and reducing water use and detailed reporting. Many also have water stewardship programs, working with local communities to preserve watersheds and increase access to drinking water. In the face of sustained and severe drought, these commitments may go some way to protecting their reputations with more sophisticated stakeholders, but mainstream opinion may be less understanding.

More from this issue

The Backlash

Most read from this issue

ISSB’s Emmanuel Faber