Respondents share how companies can boost investor confidence and trust even as AI remakes the investment research process.

Companies eager to attract investment dollars should trumpet their competitive advantage. But according to investors, most companies don’t do a great job unspooling the key part of the narrative that they most want to hear.

Those conclusions and more emerge from Brunswick’s 2026 survey of 100 US institutional active-equity investors, half long-only managers and half from hedge funds that collectively represent a broad range of capital allocators, many from the largest and most sophisticated asset managers in the world.

Investors were asked about the growing role of AI in their investment decisions, their most valued sources of information to make decisions, which factors build and destroy trust in management, what they want to see more of from companies in the year ahead, and what blind spots CEOs should watch out for.

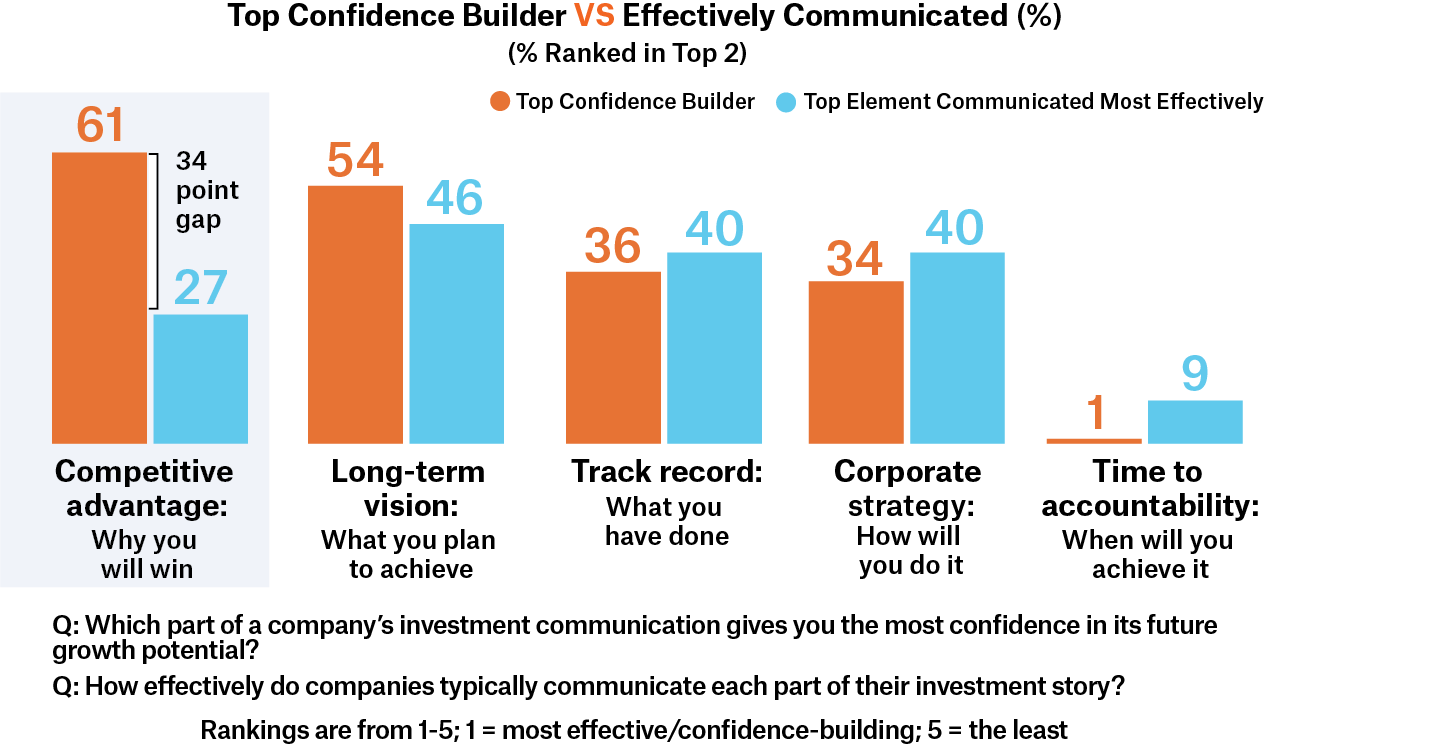

Asked what gives the greatest confidence in an investment story: 61% of respondents chose “why you will win” as most inspiring. Yet when asked to rank which of those same drivers companies communicate most effectively, “why you will win” fell near the bottom, with only 27% of investors ranking it in one of their top two selections.

WHAT MAKES A GOOD INVESTMENT STORY?

“Why you will win” is the strongest driver of investor confidence – but it’s often not well communicated.

We can hypothesize the reasons behind this disconnect. Some executives expect results to speak for themselves, while others may not want to give away the “secret sauce.” But what we heard loud and clear is that investors want more detail about a realistic path to victory mapped out. Judging from our results, being more forthcoming would make you stand out and be highly valued.

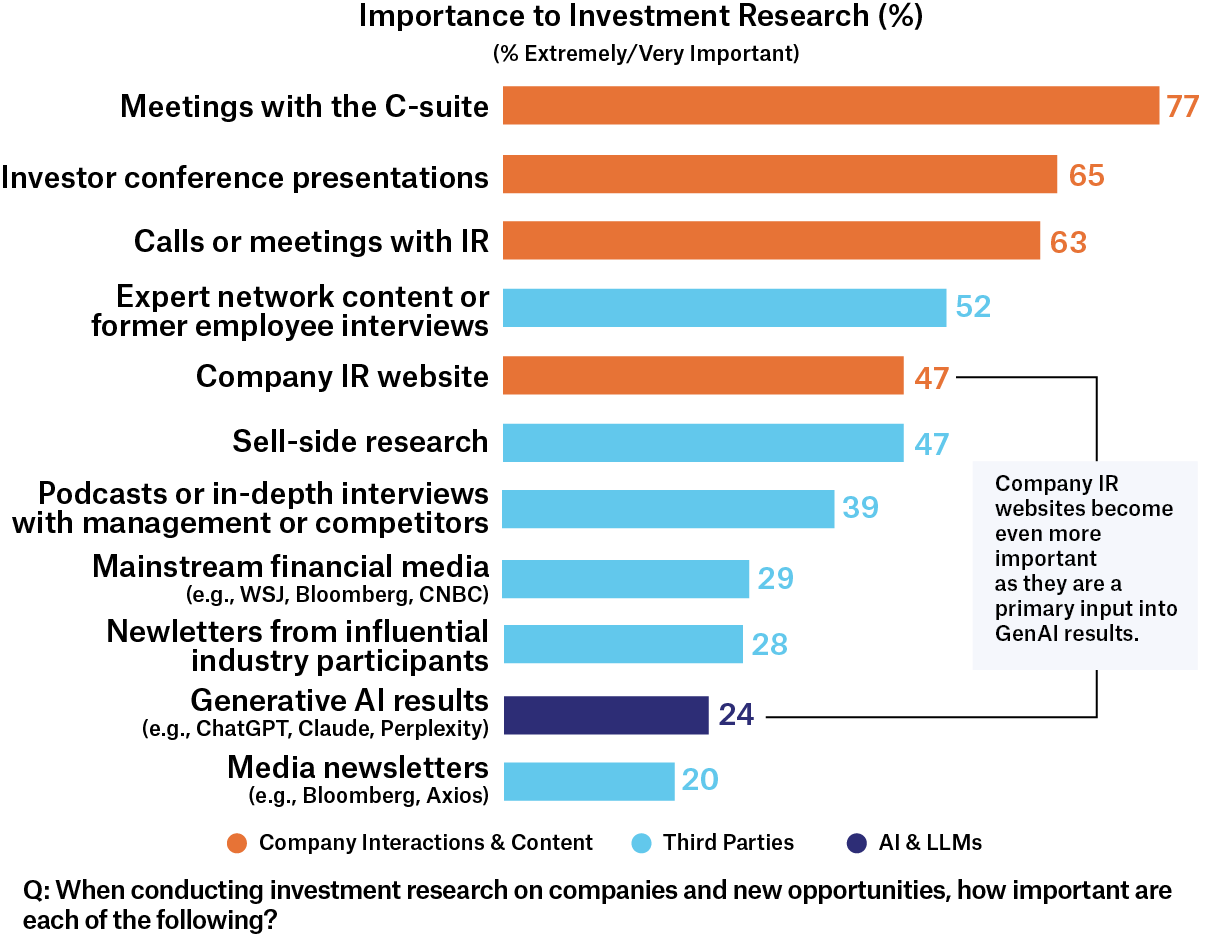

Looming large among other the important trends our survey uncovers is the growing use of AI. Even as investors take pains to steer clear of its pitfalls, 54% cited Generative AI as “moderately important,” “important” or “very important” in their investment research, with 42% citing AI as a top tool for doing deep research on new investments. Further, AI is seeping into the most fundamental investment research processes, with 68% reporting AI has changed how they approach earnings calls. AI doesn’t dominate decision making—at least not yet. Far more investors, 77% in fact, ranked human interactions with the C-suite as “important” or “very important”; company disclosures followed with 66%, and conversations with IR at 63%.

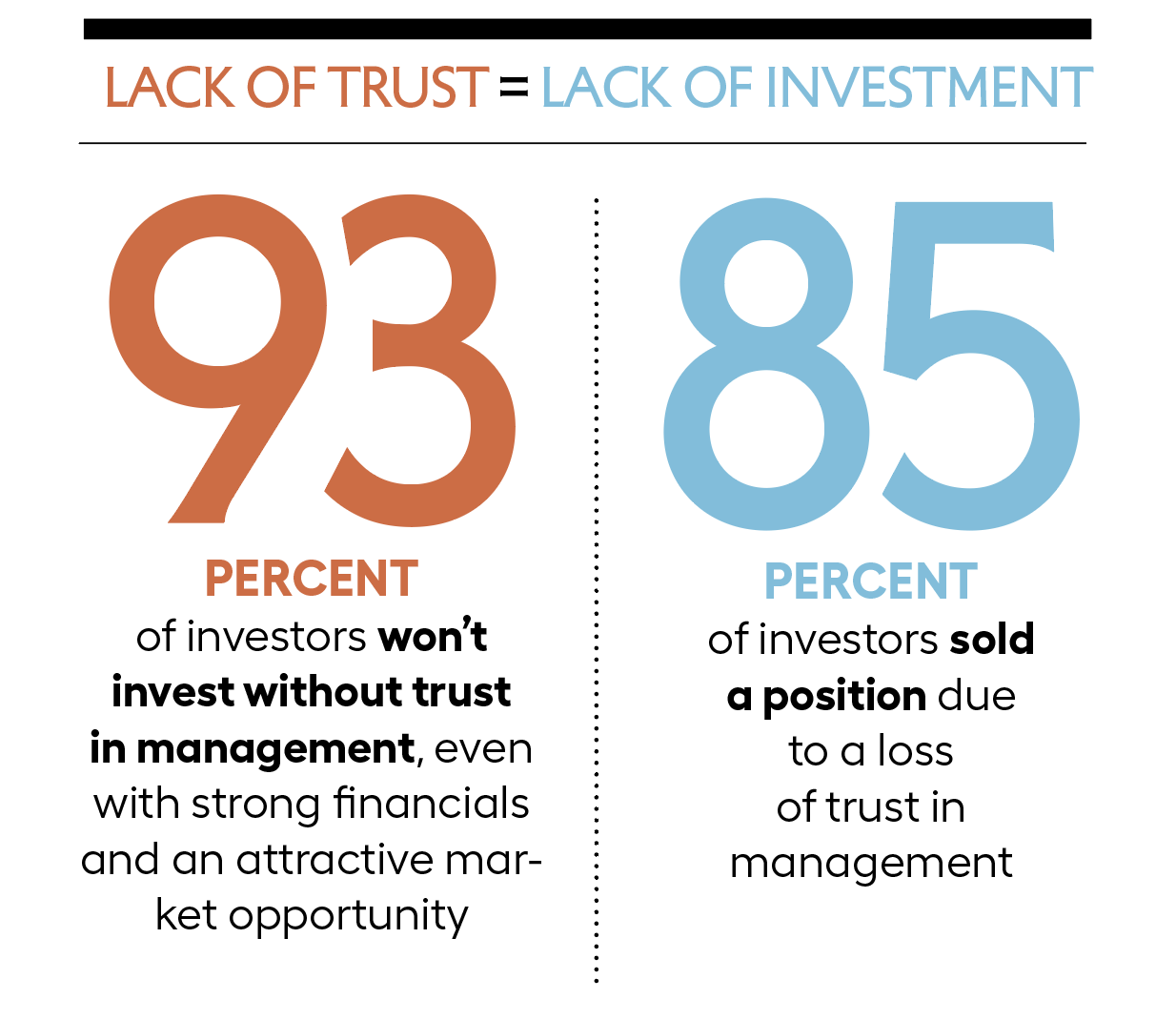

Trust

Taken as a whole, our findings support the cultivation of investor trust through transparency and clear communications. The vast majority of respondents (93%) agreed they would not invest in a company without trust in management, not even if the business had strong financials and attractive market opportunity. And 85% had sold a position due to loss of trust in management.

Among actions that can damage trust, 62% of investors surveyed saw “overpromising and underdelivering” as far and away the most dangerous faultline. Ranked second and third were the lack of a clear explanation for a change in strategy at 46%, and disappointing results without a clear plan for correction, 40%. All three ranked well above dodging tough questions (36%), blaming external factors without accepting accountability (34%), and not meeting regularly with investors (5%). Many trust killers can be attributed to failure not just of performance, but a failure of communication.

On the flip side, getting ahead of the narrative, taking responsibility, explaining actions to correct or realign strategy—these promote trust and encourage and help retain investment through the cycle. When we asked investors to rank trust-building actions, their top two selections, nearly tied at 57% and 56%, were “providing a specific action plan when problems arise” and “explaining missed expectations clearly.” These were top-ranked much more frequently than “keeping the strategy focused” (21%), and even “being highly available for investors” (18%).

Likewise, when asked what they think will be more important for companies to do in the coming year, an average of 59% of respondents chose “adapt business model to AI and technology disruption,” and 48% said “withstand and manage risk” of macro, geopolitical and operational challenges.

Changing Channels

In looking at trusted sources, it becomes clear that companies need to take responsibility for how information reaches investors. The rising use of AI means that accurate information about a company needs to be available online for ChatGPT, Claude, Perplexity or other GenAI platforms to discover. Podcasts are also steaming ahead, being top-ranked more frequently than mainstream media outlets as important sources of information for research on current and potential new investments.

Importantly, investors looking for the most in-depth content are turning first to conferences with management sources. Nearly half (47%) of respondents ranked company’s websites and Investor Relations pages as “important” or “extremely important.” Another 24% ranked GenAI results the same way—but given GenAI prioritizes direct company sources in its results, the integrity of companies’ own online information will be important to both.

DIRECT & OWNED CONTENT STILL MOST VALUED

In-person meetings remain highly important, but podcasts and GenAI results have growing influence.

Despite the fast growth of AI, investors today use it more for synthesis than direct decision making or forecasting. News, filings research and specific questions are the top uses favored. One respondent noted that using AI allowed him to quickly read the sentiment of the quarter, indirectly gauging the qualitative responses on a call. “Now I rely on AI generated transcripts which tells me the tone and manner of how management Q&A was interpreted.”

Among respondents, 84% agree that AI enables them to review much more information, dedicate more time to higher value activities and cover more companies.

But they’re not blind to AI’s weak spots, including surfacing outdated material, frequent “hallucinations,” numerical mistakes and, notably, missed context: AI “Has IQ but not EQ,” one respondent commented. Further, for the most skeptical use case, financial forecasting, only 23% said they use AI to update their models, while more than half expressed reservations about trying it.

TRUST IN AI: 42% USE AI FOR RESEARCH ON NEW INVESTMENTS

Top Investor Uses & Concerns (%)

Our findings point to immediate steps companies can take to maintain open channels of communication and accuracy of online information.

- Trumpet your competitive advantage. Articulate why your company will win supported by facts. This is the strongest driver of confidence and the biggest communication gap.

- Tell investors exactly how they should think about your performance, not just how you performed. A “numbers-first” approach without clear written conclusions risks misinterpretation by human investors and their AI tools.

- Manage expectations continuously. Make guidance achievable, define milestones and report progress consistently. When things do not go according to plan, pre-emptively alert investors to limit misses and never surprise.

- Communicate for humans AND machines. Continue to prioritize investor meetings and in-person events. Assume all available communications, including transcripts and presentations, will be increasingly parsed, summarized and compared by AI. Ensure they are coherent and aligned with a central, current strategy. Formal owned content are strategic assets and your source code.

- Be your own activist. Assume activist scrutiny is the baseline, not a special scenario. Stress-test your investment case, capital allocation, governance and performance against questions before they arrive.

Keep in mind that, despite best efforts, the concerns of management and investors can and will diverge. Case in point: A surprising 81% of polled investors agreed that “shareholder activism adds value.” But importantly, only 41% of investors last year ultimately voted in favor of activist director nominees, per Diligent data, demonstrating that clearly communicating your value proposition is critical when an activist comes knocking.

Read the full report here.