Oil-rich nations in the Arabian Gulf have seen an upswell in foreign investment since the pandemic. Brunswick’s Mahmoud Kassem describes the region’s changing reputation.

Once regarded primarily as an exporter of capital, the oil-rich Arabian Gulf is undergoing a significant transformation, becoming a magnet for foreign capital in the years following the global pandemic. Record inflows of foreign direct investment (FDI), along with the arrival of some of the world’s largest asset managers and private equity investors, have turned the region into a key emerging market investment hub.

The Arabian Gulf’s equity markets, once considered peripheral players in the global securities landscape, are now thriving. Saudi Arabia and the United Arab Emirates, the two largest oil producers in the region, are leading this renaissance with a robust pipeline of IPOs. Both nations have been doubling down on economic diversification efforts in response to oil price volatility, including the 2020 crash when crude prices briefly turned negative. This shift has prompted the partial privatization of crown jewel assets such as Aramco, the world’s largest oil company, and subsidiaries of ADNOC, the UAE’s state oil giant.

Meanwhile, spurred in part by government programs, industries seeing growth in the region include renewable energy, technology (including AI and fintech), healthcare, logistics and infrastructure, and e-commerce. Venture capital is particularly active in startups focusing on climate tech, edtech and specialized online marketplaces.

In 2023, Gulf Cooperation Council (GCC) countries saw FDI projects totaling $47 billion, with the US and UK as leading sources, according to EY. The number of projects was 22% above the prior year. While the UAE remains the prime recipient, the surge is reflected through the region.

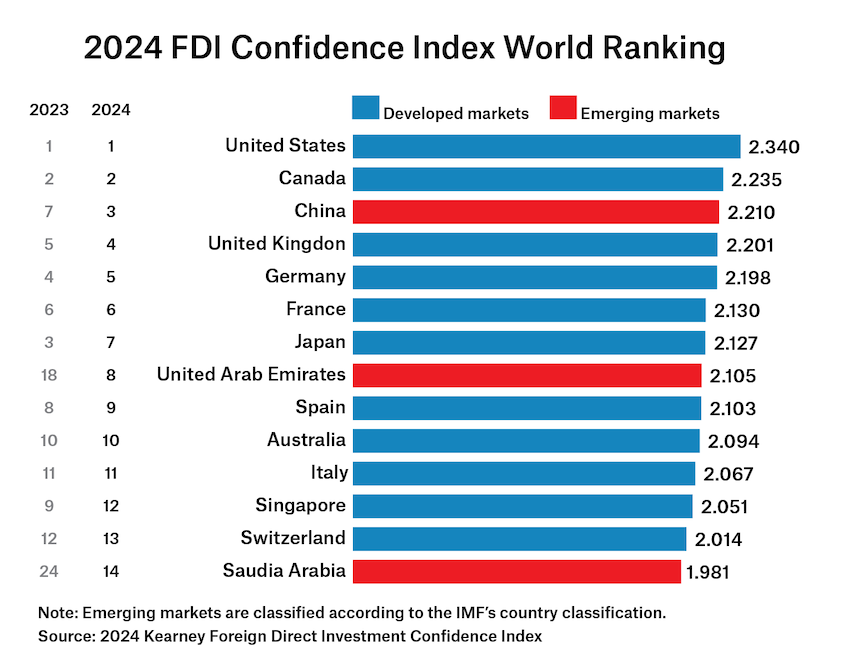

According to Kearney’s 2024 Foreign Direct Investment Confidence Index, the UAE and Saudi Arabia rank second and third among emerging markets for attracting FDI, trailing only China. The UAE has seen annual FDI more than triple to $30.7 billion in 2023, up from $10.4 billion in 2017. Business-friendly reforms such as allowing 100% foreign ownership of companies and introducing long-term visas for expatriates have played a significant role. Meanwhile, Saudi Arabia attracted $26 billion in FDI in 2023 and is targeting $100 billion annually by 2030 as part of its ambitious Vision 2030 strategy.

Private equity investors are among those flocking to the Gulf, drawn by the region’s deepening capital markets. Exchanges like the Abu Dhabi Securities Exchange, which hit a $1 trillion market cap in November 2023, offer viable exit opportunities as liquidity and market capitalizations grow. The departure of Russia from the MSCI Emerging Markets Index following the Ukraine war, and diminishing investor confidence in China’s growth story, have further bolstered interest in the Gulf’s equity markets. Despite geopolitical tensions, the Arabian Gulf has positioned itself as a beacon of stability in a volatile region. The combination of economic reforms, robust market infrastructure, and a push for diversification has created a compelling investment case.

“Institutional investors recognize the Arabian Gulf as a safe haven for capital, particularly given its economic stability, robust governance frameworks, and fixed exchange rates tied to the US dollar,” said Hitesh Asarpota, CEO of Emirates NBD Capital, the investment banking arm of Emirates NBD, Dubai’s biggest bank. “The region’s success in diversifying its economy and building resilient capital markets has positioned it as a premier destination for global capital,” Asarpota said.

Asset managers in the region have also benefited from this surge in international interest. Some of the world’s largest institutional investors are allocating funds to managers based in GCC nations, citing stability and growth opportunities. Notable players like BlackRock, Brevan Howard, and Ray Dalio’s family office have recently established a presence in the Abu Dhabi Global Market, signaling confidence in the region’s burgeoning financial ecosystem.

“Over the past three years, we’ve seen a marked increase in third-party capital flowing into regional funds from a diverse range on global institutional investors,” noted Mohamed Al Nowais, Managing Director of Waha Capital, which oversees a diverse portfolio of investments, including its flagship $900 million MENA Equity Fund. “This demonstrates a strong appetite for exposure to the Arabian Gulf, particularly given its unique blend of economic stability and growth potential.”

Saudi Arabia has emerged as a standout performer in global markets. The MSCI Saudi Arabia Index advanced by 10.7% in 2023, compared to an 11.2% decline in the MSCI China Index. The kingdom’s weighting in the MSCI Emerging Markets Index has climbed from 1.4% in 2019 to over 4% today, reflecting increased investor confidence.

“The resilience of markets in the Gulf amid the recent global volatility and heightened geo-politics is a testament to the success of the initiatives taken to grow the economy and capital markets,” said Saad Chalabi, CEO of xCube, a Dubai-based brokerage and market maker. “This region has shown how effective economic reforms, coupled with a focus on diversification and innovation, can truly redefine a market’s potential. This has made it an attractive investment hub for both institutional and retail investors worldwide.”