Surveying global ESG regulation can be a bit like looking at a spattered Jackson Pollock canvas: a lot going on, some of it striking, but tough to comprehend all at once. Particularly suitable is the painter’s 1947 “Sea Change”—for one is certainly underway today in ESG regulation.

In October 2023, Sustainable Fitch, a company that’s part of the credit ratings agency Fitch Ratings, estimated “there are 100 different disclosure regulations in place or under development around the world.” Companies are struggling to keep up—research by KPMG found that three out of four companies worldwide feel unprepared for coming ESG regulation.

The EU and US attract a disproportionate amount of attention when it comes to the topic—the EU because it is in the vanguard of legislating ESG, and the US because of its fiercely politicized and polarized debates. In between those two extremes lies the rest of the world.

Gone Global: ESG-Related Interventions

According to law firm Hogan Lovells, more than 75 different countries and territories have “regulations, laws and voluntary standards that impact ESG-related issues in each jurisdiction.” The scale and scope of those ESG-related interventions vary widely. Some countries have dated laws pertaining to the environment; others have legislation spanning a huge range of ESG-related issues. The map’s most powerful takeaway might be its most obvious: how common ESG-related standards and laws have become.

Argentina: Sustainable and ESG Collective Investment Products (General Resolution 885/2021).

Nigeria: Guidelines for Implementation of the IFRS Sustainability Disclosure Standards.

Indonesia: Indonesia Green Taxonomy Edition 1.0.

Abu Dhabi, UAE: Sustainable Finance Regulatory Framework.

Canada: Green and Transition Finance Taxonomy.

Brazil: Resolution 193 (IFRS Sustainability Disclosure Standards).

United Kingdom: Sustainability Disclosure Requirements (SDR) and investment labels.

European Union: Corporate Sustainability Due Diligence Directive.

Australia: Australian Sustainability Reporting Standards —Disclosure of Climate-related Financial Information.

The Pace Is Quickening

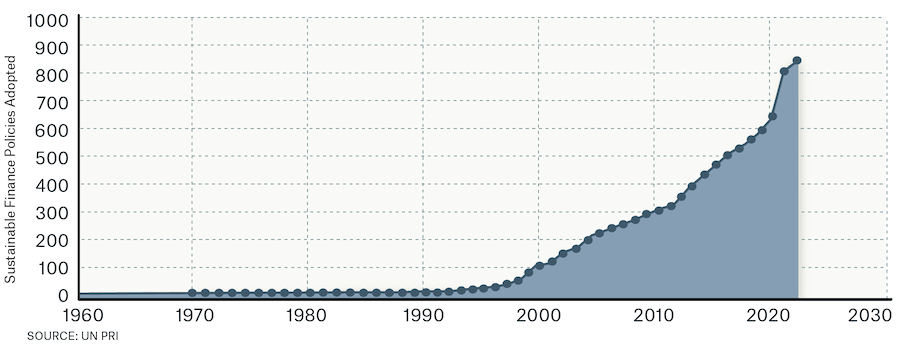

Research by ESG Book, which provides ESG data and technology, found that ESG regulation has increased 155% over the last decade. In sustainable financial regulation, the UN’s Principles of Responsible Investment, an international network of financial institutions whose signatories manage more than $120 trillion, found that 2021 saw more than double the amount of “new or revised policy instruments” than any year before it.

Around the ESG World in Three Laws

Nigeria, Indonesia and Brazil aren’t the names that come to mind when one thinks of ESG regulation. Yet they are home to almost a combined 700 million people, and a look at some recent ESG-related laws offer a glimpse of just how differently countries are approaching the issue.

Nigeria

Name: Guidelines for Implementation of the IFRS Sustainability Disclosure Standards.

Authority: Financial Reporting Council (FRC) of Nigeria.

In a nutshell: A bit of background is helpful to understand what’s going on in Nigeria. The International Sustainability Standards Board (ISSB) was created at COP26 to help meet the demand for a global standard for sustainability disclosures. It is part of the International Financial Reporting Standards (IFRS) Foundation.

Nigeria will be implementing the ISSB’s IFRS S1 and S2 standards that deal with sustainability disclosures. The S1 standards apply to a wide range of ESG issues; the S2 standards are more focused on climate. “Together, these standards play an important role as a benchmark for global sustainability reporting efforts,” the Cambridge Institute for Sustainability Leadership wrote.

Nigeria’s FRC announced its intention to be an early adopter of the standards at COP27, being the first African nation to do so.

Status: Proposed.

Timeline: Announced in November 2022, launched in July 2023 and confirmed via a notice for document submissions in October 2023.

Brazil

Name: Resolution 193

In a nutshell: The Brazilian Ministry of Finance and Brazil’s finance regulator, the Comissão de Valores Mobiliários (CVM), announced that the ISSB’s IFRS disclosure standards will be incorporated into Brazil’s regulatory framework. The CVM issued Resolution 193, which allows listed companies and investment funds to use the ISSB standards for sustainability-related disclosures. For the first year of voluntary reporting, the CVM will adopt the current ISSB standards before moving to the Portuguese translations of the IFRS once they are completed.

Status: In effect.

Timeline: Announced in 2023; companies can disclose information as per the ISSB standards from 2024; disclosing using those standards is mandatory from 2026 for Brazilian listed companies and other CVM-regulated entities.

Indonesia

Name: Indonesia Green Taxonomy Edition 1.0

Authority: Indonesian Financial Services Authority (OJK)

In a nutshell: A voluntary act that encourages financial sectors to classify green activities using a traffic light system, as well as monitor credit and investment flows, and mitigate greenwashing.

The taxonomy was designed as a “living document” to acknowledge the ongoing transition. It can also accommodate new sectors, and evolve along with international benchmarks.

Status: In effect.

Timeline: Introduced in January 2022.

… And the Rest of the World

This list goes on. Without leaving the first letter of the alphabet, you could look at Abu Dhabi’s Sustainable Finance Regulatory Framework, Argentina’s general resolution on Sustainable and ESG Collective Investment Products, or Australia’s Sustainability Reporting Standards—Disclosure of Climate-related Financial Information.

ESG regulation also continues in both China and India. Institutional Investor points to the Indian government’s “policy commitments around renewables, healthcare and financial inclusion,” while a 2023 report from Morrow Sodali, an advisory firm, concluded that “the Chinese market has been undergoing an increasingly more visible transformation in terms of its commitment to ESG.”

Three Headliners for 2024

In a crowded field, three pieces of ESG regulation are set to stand out in 2024.

First, the EU’s seismic Corporate Sustainability Reporting Directive (CSRD), which went into effect at the start of the year. It will require around 50,000 companies in Europe to start reporting on their climate impact.

Second, the UK’s Sustainability Disclosure Requirements (SDR) will go into effect at the end of May—rules meant to combat greenwashing in the financial sector. It was created by the Financial Conduct Authority, a financial regulator, to make sure that firms’ “sustainability-related claims are fair, clear and not misleading.” It will also shape how financial products can be labeled, named and marketed “so products cannot be described as having a positive impact on sustainability when they don’t.”

Finally, the US’s Securities and Exchange Commission in March released its long-awaited rules around climate disclosure and ESG investing—rules that many expect to face legal challenges.

A Tipping Point?

At the World Economic Forum Annual Meeting in Davos this year, Emmanuel Faber (read his interview here), said that the world faces “a regulatory tipping point.”

“The reason is that while new measures are being introduced to promote sustainability reporting, they are not all being implemented in the same way across regions,” the Financial Times explained. “That means the world is either heading towards increased fragmentation, which will be hard for companies to navigate, or momentum may emerge for a more unified model.”