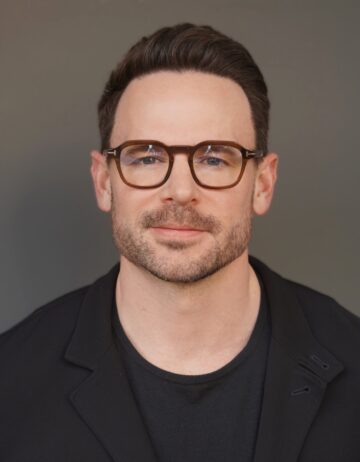

A key US researcher on climate data transparency says investors should demand more information regarding risk exposure.

“People have been hurt by corporations’ failure to adapt to the foreseeable climate impacts,” argues Professor Madison Condon of Boston University’s School of Law, a researcher and policy maker on climate-risk transparency. Businesses should have known such impacts were coming, she says, and investors should have insisted that those corporations make the changes necessary to adapt.

If it seems a harsh assessment, it is one that has the ear of many in Washington. Condon’s research has significantly influenced climate-related rulemakings by the US Securities and Exchange Commission (SEC) and the US Department of Labor. Additionally, the President’s Council of Advisors on Science and Technology has cited her work in its recommendations for managing extreme weather risk.

Condon, a Harvard Law School graduate, has authored numerous works that emphasize the disparities in climate risk information accessibility within the financial sector for both public and private entities. US corporations and business leaders, she says, have inadequately disclosed material climate-related information to investors, adversely affecting the investment landscape and market projections. Greater transparency and rigorous cross-checks by multiple parties are crucial for refining the accuracy of scientific analyses, models and data projections, she says.

“Most of the asset-level data available is proprietary and black boxed, so it’s very hard to vet if it’s accurate or not,” Condon said in an interview with Brunswick. “It’s not widely available, and it does create information asymmetries between hedge funds and the public—or hedge funds and farmers—about what is going to happen in the future. Right now, there is not enough public provision of this downstream adaptation information.”

How significant is the climate risk information problem for businesses?

There’s no doubt that this has already been impacting businesses … and there are many different categories of people that are harmed by the under-assessment of risk. Cocoa and coffee are two of the crops that I’m really paying attention to lately, because climate change has already this year and last year really manifested in a lot of price breaks in both industries.

The insurance and the utilities industries are areas of concern—when you have Warren Buffett calling for a national bailout of all utilities, things have become pretty dire. We’re still catching up with the manifestation of the effects.

The Federal Reserve Bank of Dallas even released a study that climate change had already pretty significantly impacted Texas’ GDP growth, just in the past year. It’s still early days. And already economists are beginning to point to those effects.

My understanding of the climate science is that things are going to be rough in the year 2050, no matter what we do. I think there are going to be economic losses at the scale of GDP percentages, potentially many GDP percentages. In my scholarship, I called for greater federal and state funding of adaptation science from tomorrow to 10 years out.

What is your vision for the future of climate risk information as an investor?

I think we need a return to big interdisciplinary science, with many people tackling this question from different places, trying to get it on the web in a downloadable form, manipulable form, and transparent form, where you can poke around with the models, and see what assumptions were made.

My vision is to have more eyes on the things we’re predicting, so we can see if they’re right.

“The idea that the SEC’s climate disclosure rule is layering on excessively expensive and overly burdensome reporting requirements is simply not true.”

Should the SEC play a role in overseeing climate risk information? What are your thoughts on the SEC’s latest ruling on climate disclosure?

The SEC has a mandate with the federal reserve to oversee credit ratings agencies, though, they don’t really exercise that power, nor do they have the in-house capacity to assess whether [the current] climate data is correct. No one at the SEC has a climate science degree, so both the regulated entities and the regulators are trying to figure out where the gaps are and how to fill them.

I admire the SEC because a bunch of people who had never thought about climate change before had to get up to speed on the language and discourse around climate change and various voluntary international initiatives that are quite lingo-heavy. The idea that the SEC’s climate disclosure rule is layering on excessively expensive and overly burdensome reporting requirements is simply not true. This concerns multinational companies that will have to be collecting and reporting this information to investors regardless, and the idea that this is simply the SEC trying to secretly regulate climate change just doesn’t pass muster.

Which company or industry is effectively addressing the climate risk information problem? What are the implications for investors?

Some wealth managers and other companies are demonstrating a willingness to engage with this issue, driving the conversation forward and promoting investor trust in the process. For example, Wellington, a Boston-based independent asset manager, realized very early on that physical climate risk was gonna be something that their active managers needed to take seriously—they were one of the leaders in realizing that climate science was an important part of financial risk assessment.

Retirement planning is also an area where pressure for such disclosure around investments is becoming critical. Similarly, the insurance and utility industries are underappreciated for their vulnerability in investor portfolios with regard to climate risk, particularly in the US.

Although there’s been more discourse among companies around how to better serve retirees and investors for the long term, it still feels like the early days for these conversations. I don’t think that investors are asking the asset managers, who theoretically have a long-term investment horizon, whether or not they’re doing their job when it comes to climate change and ensuring that there will be money waiting for investors in the year 2050.

What are your thoughts around the recent rise in climate litigation? What is the litigation risk for companies and what do these lawsuits mean for investors?

How these suits progress in the US hinges a lot on the Supreme Court, which isn’t the biggest climate champion. There are so many different lawsuits against companies causing climate change—it seems the dam is going to break at some point and a number of these lawsuits are going to be successful. I am more hopeful for suits that are outside of the US, that could still affect American companies.

This is clearly a material, financial risk that you, as an investor should be aware of, if the company you’re invested in is being sued in a number of different courts.

What role should the government play in overseeing and managing climate risk for corporations and investors?

There’s growing political will to have the government be more involved, and the realization is dawning that the government needs more data, in a lot of different spheres. For example, the CHIPS Act, the Inflation Reduction Act, and the Jobs and Infrastructure Act were passed in response to us realizing that our supply chains were sprawled out across the entire world, exposing us to fragility.

Another example is the insurance industry, which has a monopoly on asset-level risk information. Investors want some oversight of whether the prices they’re charging are fair, and I argue that we should have more of a public government-funded provision of this information, as a double check on what the insurance industry has decided to charge us.

In general, the government should be more empowered to collect data from market actors, both public and private. The government could play more of a role in industrial policy, picking winners, and trying to foster the economy at home, and in order to do that well, the government needs new information about what these markets look like.

I’m not sure that the conversation has fully connected the dots in collecting more information from private corporations, but I think we could get there.