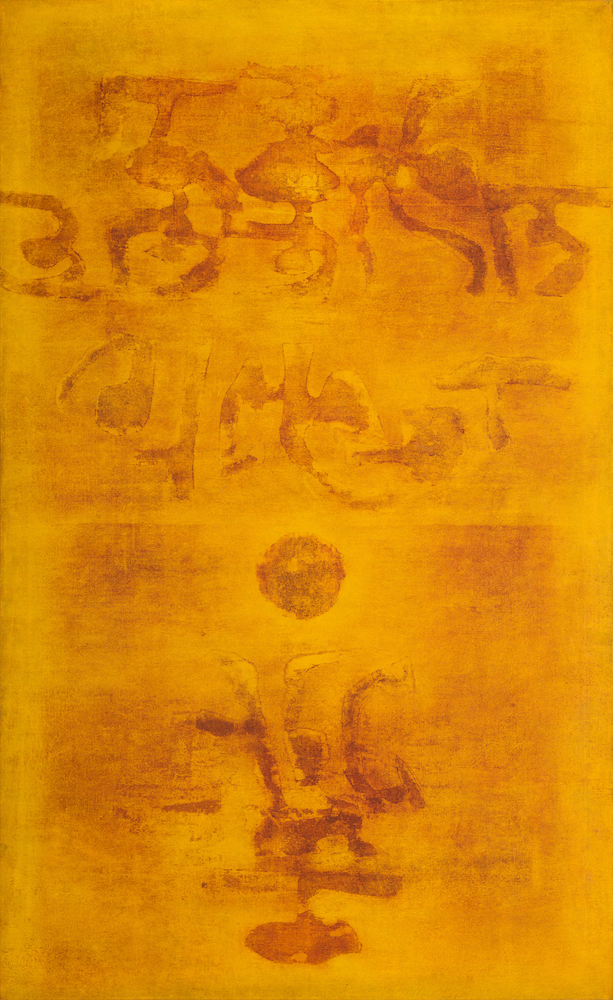

Above, “The Story Teller,” a 1937 oil painting on canvas by Indian artist Amrita Sher-Gil (1913-41), was purchased at a New York auction in 2023 for nearly $7.5 million. Sher-Gil has been called one of the greatest women avant-garde artists of the 20th century.

Art night in Mumbai on Thursdays is a hip, bar-hopping style experience. Centered in what was once the red-light quarter, the focus is a string of galleries open to aficionados, casual strollers and tourists. The former “noir Mumbai” is no longer in evidence, its edginess replaced by an exciting, thriving art market. The scene is part of a larger transition that has opened new doors for culture and investment in India.

In Delhi, on the edge of the city, another emphatic symbol of change is rising: the new home of the Kiran Nadar Museum of Art (KNMA). Opening in 2027, the facility will greatly expand the footprint of the museum, which first opened in 2010. With her husband, technology billionaire Shiv Nadar, Kiran Nadar is a ceaseless private collector of artwork, part of a new wealth engine driving the transformation of the country’s cultural life.

“Years of commitment to Indian and South Asian art by institutions, private collectors and foundations are finally seeing results,” Nadar told Brunswick in a recent interview. “There is a global interest in our region right now—this is obvious from the number of artists being represented at the 60th Venice Biennale, and institutional exhibitions currently on view that showcase South Asian artists: Public Art Fund showing Huma Bhabha in NY, the Museum of Fine Arts Houston showing Raqib Shaw, The Barbican showing Ranjani Shettar, Yorkshire Sculpture Park showing Bharti Kher—among others.”

From princely patronage to entrepreneurial support, from narrowly held collections to plural spaces, from art as history to art as the future—India’s cultural sector is experiencing a swelling wave of growth and change.

In 2023, Indian and foreign auction houses recorded their best year in more than two decades. At a New York auction, Syed Haider Raza’s “Gestation” fetched $6 million and Amrita Sher-Gil’s “The Story Teller” sold for $7.5 million—the highest-priced Indian painting ever.

When the new KNMA opens in 2027, it will be the largest visual arts museum in the country, with more than 10,000 contemporary works across a million square feet. Kiran Nadar will then rival another Indian Croesus in the competitive stakes of cultural philanthropy, Nita Ambani. The Nita Mukesh Ambani Cultural Centre in Mumbai opened a year ago and has surprised this city of anglophile elites with the breadth not only of its Indian programs, but also major exhibits of Western art. A recent NMACC exhibit for instance, “Pop: Fame, Love and Power,” featured American pioneers Andy Warhol, Roy Lichtenstein and Keith Haring, among others.

“The landscape of art has changed drastically in India, with the emergence of new cultural and creative spaces in art, photography and design,” Nadar says. “These initiatives hint at the inclusion of art in every realm of life.”

Nadar sees KNMA’s new facility being built on that idea, serving not only as a new museum space but as “a place for cross-cultural collaborations and learning,” as well as exhibitions, performances, workshops and other community uses.

From 1999, the painting “Untitled (Bull on Rickshaw)” by Indian artist Tyeb Mehta (1925-2009) recently sold for $5.5 million.

Beyond Borders

The boom in the art market may be primarily the result of the reforms and growth of India’s economy over the last three decades. But there was another important if less obvious factor: homesickness.

Dinesh Vazirani is Co-founder and CEO of SaffronArt, India’s largest auction house. Vazirani was an arts student at Stanford University in the US, where he met his wife, Minal, then also a student. They sensed a “fast-growing sector on the horizon” and returned to India, setting up SaffronArt.

According to Vazirani, the repricing of Indian art can be traced to the experiences of others like himself, expatriates looking back at their home country. Representing an estimated 6% of Silicon Valley’s workforce, Indians are now also the wealthiest minority community in the US.

“Modern Indian art began with these non-resident Indians nostalgic for their homeland, realizing their native artworks were undervalued and therefore very collectible,” Vazirani says.

Rajiv Chaudhri, President of Sunsara Capital, an investment firm focused on solar energy, and his wife Payal are leading examples of this trend. Chaudhri began collecting Indian art in the mid-1990s, and in 2005 paid a landmark $1.6 million for Tyeb Mehta’s 1997 work “Mahishasura.” Museums and public institutions also benefit from such commercial sales—“Mahishasura,” for instance, has appeared on loan in museums in Boston, Los Angeles and New York.

The Tate in London, the Guggenheim and the Metropolitan Museum of Art, both in New York, and the Pompidou Centre in Paris are all familiar locations for auctions and exhibits in the globalization of Indian art. Dubai and Singapore, both centers of Indian immigration and wealth, are adding to the same critical mass.

India Market

For centuries, the best art in India itself was only to be found in palaces and the mansions, called “havelis,” belonging to the maharajas. As recently as 30 years ago, there were just a half-dozen reputable galleries across Delhi, Mumbai, Kolkata and cities in the South.

Today, that number is at least 50, with a very long tail of sales activity following soaring valuations.

The value of the top 50 artworks in 2023 was calculated at Rs 252.61 crore, or over $30 million, roughly three times what it was in 2021. The works of artist MF Husain have ballooned 100 times in value over the last 25 years, while others’ works have grown as much as 500 times in value, including those by SH Raza, FN Souza, Raja Ravi Varma, Amrita Sher-Gil, Tyeb Mehta and VS Gaitonde. As a result, wealth managers are now beginning to include art as part of client investment portfolios.

From 1980, “Untitled” by VS Gaitonde (1924-2001) sold for $5.7 million in 2023, more than double it’s original estimate.

“Art is emerging in India as an alternative asset class,” says Ajay Piramal, Chairman of the Piramal Group and Founder of the Piramal Art Foundation. What’s needed now are applications to facilitate continued growth, he adds. “All this can be accelerated with the right use of digital technologies and building a good platform where the ecosystem can manage these assets,” he says. “Building a registry for art will provide confidence and trust to collectors.”

In his showroom in Mumbai, Vazirani leafs through a catalogue to point out an orange-hued work by the artist VS Gaitonde. The piece sold for $5.7 million to a European collector in 2023—more than double its original estimate. “It’s the ‘Roaring Twenties’ again,” Vazirani says, referring to the US “Gatsby”-era prosperity.

Abhishek Poddar, a leading curator of photography and Founder-Trustee of the Museum of Art and Photography in Bengaluru, started off collecting art in the 1980s. He recalls a time when “a piece of art was cheaper than a Lacoste T-shirt.” He welcomes the increased valuations for artwork, and notes the educational value of India’s growing art scene that works in tandem, bolstering the market by strengthening Indians’ confidence in their own cultural identity.

“Art mirrors a country’s prosperity,” Poddar says, “but when people take pride in their culture, that’s when velocity takes off.”

Piramal’s observations support that assessment.

“There seems to be one private museum or cultural center opening around the country each month,” Piramal says. “Over the years, more and more children are going to have access and interaction with high-quality art and this will certainly impact the generations to come.”

Old Growth, New Shoots

As the market heats up, a trend toward exhibition-at-scale threatens to alter it yet again. India’s organized museums and galleries are sweeping up exhibitable art—a “vacuum-cleaner effect” that leaves fewer pieces for sale in private auctions. The Taj Mahal Palace Hotel, a giant competitor of the gallery district in Mumbai, has its own engine of galleries set up by DAG, one of the largest dealers in Indian art.

In response, the art itself is becoming more daring and leading its audiences toward broader tastes. Sangeeta Raghavan, gallery director at Art Musings in Mumbai notes that “today’s buyer is younger and more open to artistic mediums such as digital multimedia art, photography and installations, not just paintings.”

Paresh Maity, a mature, critically acclaimed artist from West Bengal regarded as perhaps India’s foremost water colorist, sees that effect in the growing proliferation of sculptures in the public arena, where there had been none.

Ajay Piramal: Over the years, more and more children are going to have access and interaction with high-quality art and this will certainly impact the generations to come.

“Today pick any hotel, airport, city street or town square and there is likely to be some sculpture or artwork on display,” he says.

Sunil Munjal, billionaire investor, Chairman of Hero Enterprises and Founder of the Serendipity Arts Festival says the trend goes far beyond any one discipline. “The reception towards disruptive mediums, lens-based works and works that engage is unbelievable.”

Based in Panaji, Goa, the Serendipity Arts Festival is a major annual event that last year held over 450 events involving more than 3,000 creative professionals, performers and practitioners. The 2024 edition, Munjal promises, will be even more varied, innovative and immersive.

Big Picture

What this all adds up to is an India art market nearing $500 million. That may not be on the scale of the steel manufacturing or financial services sectors, but it is undeniably a significant economy in its own right—and still growing.

“Unlike the Western art market, which has had centuries to evolve and mature, the Indian art market is still relatively young,” KNMA’s Nadar says. “The culture of living with original artworks is a relatively new concept in the region but is rapidly catching on.”

Munjal also sees plenty of room for further growth, and says the key lies in strengthening the public knowledge base.

“There is a need for revival,” Munjal says. “As in the West, museums must be part of larger policy, institutional and educational set-ups so awareness and popularity can grow.”

But the trajectory is clear: Valuations will continue to rise. As the auctioneer Vazirani says, “The best is ahead.”